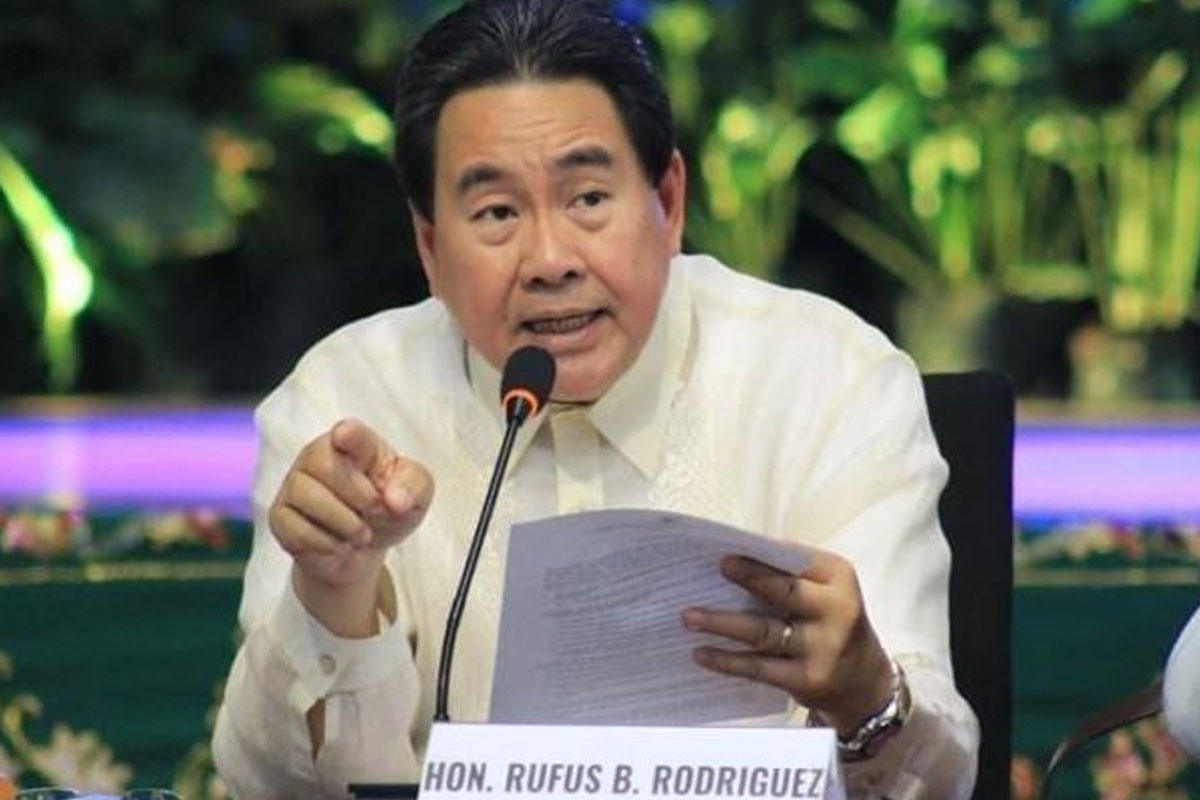

LAWMAKER MOVES TO CLARIFY TAX PERKS FOR EDUCATIONAL INSTITUTIONS

DEPUTY House Speaker Rep. Rufus Rodriguez has filed a measure seeking to clarify the tax perks granted to educational institutions under the Corporate Recovery and Tax Incentives for Enterprises or CREATE law.

The lawmaker filed the bill following the issuance by the Bureau of Internal Revenue of a directive increasing the tax rate of private schools by 15 percent.

House Bill 9577 seeks to correct a provision in the CREATE law that was wrongly interpreted by the BIR to subject all private schools that are run by stock corporations to a 25-percent income tax, Rodriguez said.

“This bill seeks to make it clear that the preferential tax rate of 10 percent—reduced to one percent from July 1, 2020 to June 30, 2023—applies to proprietary educational institutions, by amending the first sentence of Section 27 of the NIRC,” the lawmaker said.

“With the bill, I hope the BIR will see that the intent of the law is to really give all proprietary educational institutions a preferential tax of 10 percent, which from July 1, 2020 to June 30, 2023 is one percent,” he added.

Rodriguez warned more schools will be forced to close down or raise their tuition and other fees if the BIR will continue to impose higher tax rate on private schools.

He called on the BIR and the Department of Finance to rescind the controversial tax regulation immediately because it contradicts the intention of the CREATE law.

“Instead of helping these educational institutions, the BIR has made their situation worse by increasing their tax by 150 percent, from 10 percent to 25 percent,” the lawmaker said.