EBET ACT TO NARROW JOBS MISMATCH GAP, BOOST CAREER DEVELOPMENT — SENATOR

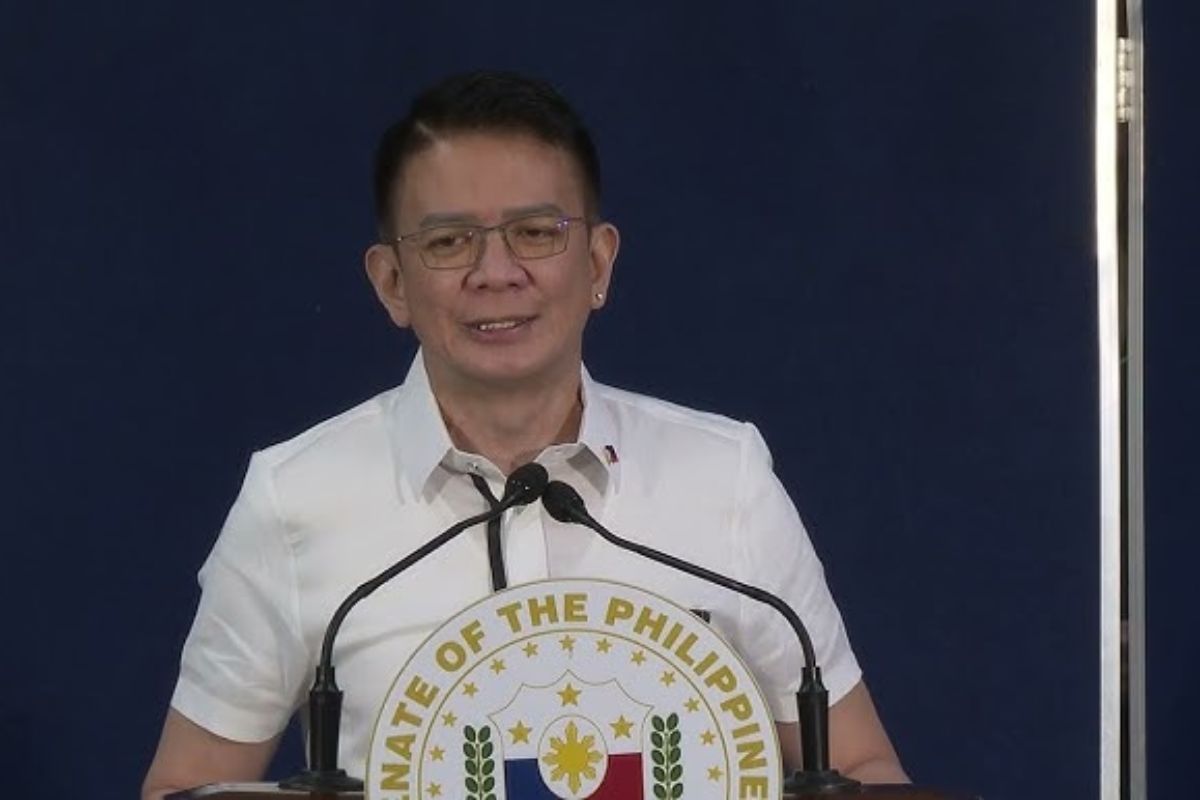

SENATE President Francis Escudero emphasized that the Enterprise-Based Education and Training Framework or EBET Act, which institutionalizes and strengthens apprenticeship programs in the country, will pave the way for the development of more Filipinos into highly skilled and globally competitive workers.

Escudero said the EBET Act, which will be signed into law on November 7, is a key step toward bridging the gap between education and industry and preparing the Filipino workforce to meet the demands of the Fourth Industrial Revolution.

A priority measure of the administration, EBET seeks to address the persistent issue of the jobs-skills mismatch that has long been a barrier for many Filipinos in securing employment or better-paying jobs.

With the EBET, employers will be incentivized to offer apprenticeship programs for low to mid-level and higher-level skills for new entrants into the labor force.

Employees seeking to upskill for career progression will also benefit from the EBET.

“With a rapidly evolving labor market, one cannot afford to remain stagnant. The requirements of enterprises are constantly changing, so jobseekers and employees alike must adapt to survive,” Escudero said.

Filed as Senate Bill No. SBN 2587, the EBET was authored by Senator Joel Villanueva, who sponsored the bill as head of the subcommittee on enterprise-based education and training to employment.

Escudero, who chaired the committee on higher, technical, and vocational education — the parent committee of Villanueva’s subcommittee — noted that by developing and strengthening individuals’ knowledge and skills, it will be easier for them to secure more fulfilling and meaningful jobs and enhance their opportunities for career advancement.

Under the law, the duration of the EBET program shall not exceed three years. EBET trainees will receive allowances to cover transportation, meals, or any other agreed-upon expenses.

Successful candidates who demonstrate competence in full or partial qualifications will be awarded a National Certification or a Certificate of Competency.

Incentives will be provided to participating enterprises, including an additional tax deduction of 50% of actual training expenses, increasing to 75% by 2028.

An EBET one-stop shop, or online portal will be established to facilitate the efficient and accessible availment of the law’s incentives.